CLIMBS: Trailblazing Cooperative Insurance in the Philippines for a Resilient and Sustainable Future for All

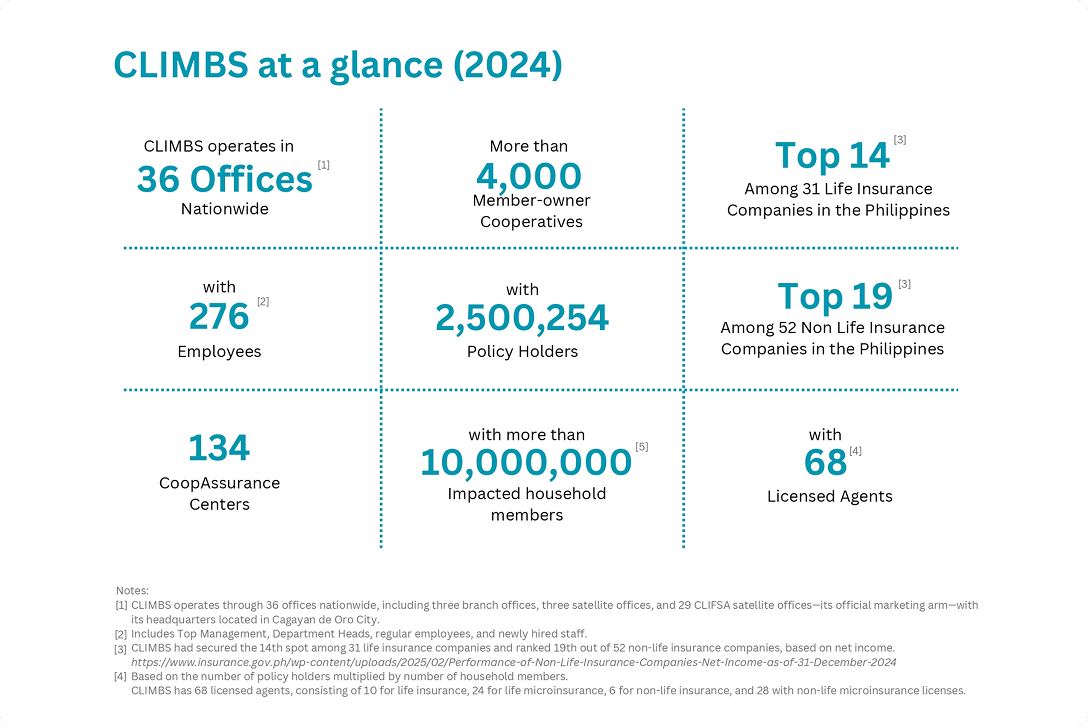

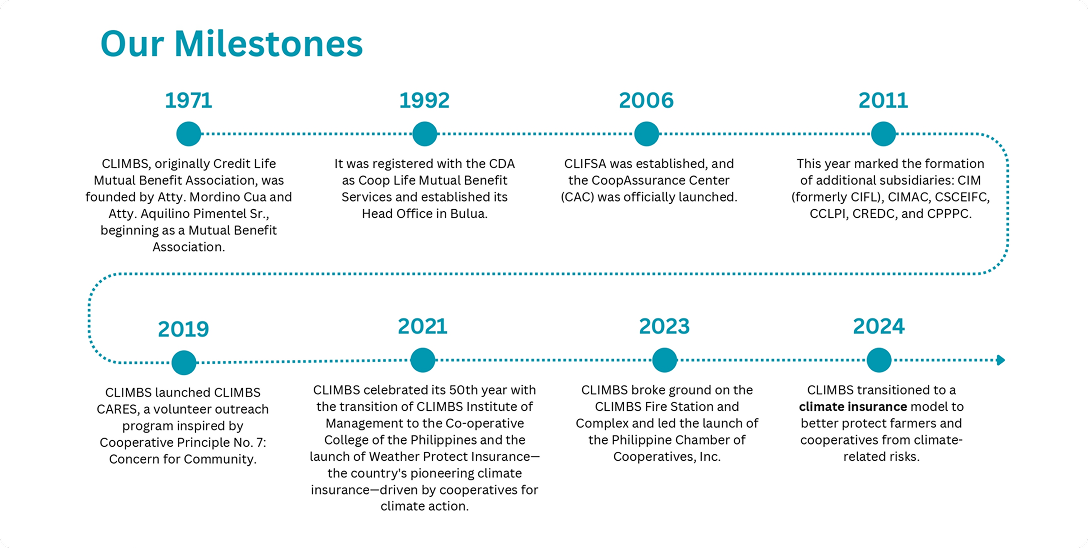

Since 1971, CLIMBS Life and General Insurance Cooperative has been a steadfast advocate for financial security —offering life and non-life micro-insurance solutions designed for cooperatives and grassroots communities. Grounded in cooperative principles, CLIMBS champions accessible, inclusive, and sustainable protection for Filipinos nationwide.

Expanding Reach, Empowering Lives

From its humble beginnings in Cagayan de Oro, CLIMBS has evolved into a dynamic, nationwide network—partnering with primary cooperatives through its CoopAssurance Center (CAC) model. With strategic branch offices in Quezon City, Davao, Cebu, Naga, Baguio, and Iloilo, and satellite offices across the Philippines, CLIMBS continues to broaden its impact. Through innovative financial solutions, it safeguards livelihoods, strengthens community resilience, and contributes to the global movement for inclusive insurance.

Connecting the world through global partnerships, CLIMBS actively collaborates with international organizations to exchange knowledge, scale best practices, and drive financial inclusion across borders—empowering cooperatives and communities both locally and globally.

1970s: The Beginnings of Protection

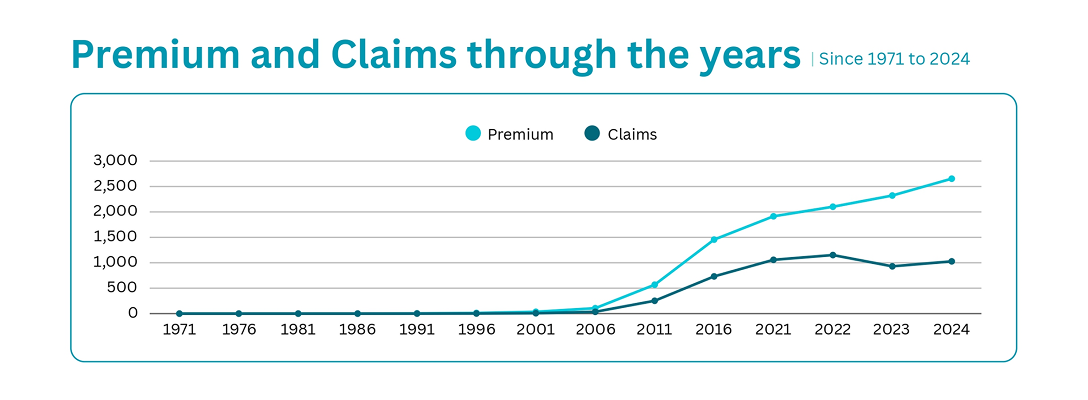

The 1970s marked the humble beginnings of CLIMBS. In 1971, the cooperative collected only 0.01 in premiums, with no claims filed—evidence of a small, emerging market. By 1979, premiums had grown to 0.18 and claims to 0.04, showing slow but steady growth. During this period, CLIMBS was laying the groundwork, building trust, and introducing the concept of mutual protection among cooperatives.

1980s: Emerging Stability and Agility

The 1980s brought about a sense of stability, as CLIMBS gradually expanded its reach. Membership grew, and so did confidence in the cooperative model. Toward the latter part of the decade, the organization faced unexpected changes—likely stemming from internal transitions or external events. These challenges tested CLIMBS’ resilience and highlighted the need for adaptability in a changing environment.

1990s: The Dawn of Expansion

In the 1990s, CLIMBS entered a transformative era. No longer a small player, it began to grow rapidly in reach and relevance. The demand for cooperative insurance increased as more communities recognized the value of protection. CLIMBS responded by strengthening its network, enhancing member services, and laying the foundation for large-scale expansion in the years to follow.

2000s: Acceleration and Innovation

This decade marked a period of dynamic growth. CLIMBS accelerated its development, adopting more modern systems and launching products tailored to emerging risks. The cooperative’s ability to adapt to economic shifts and climate challenges helped it grow both in scale and in impact. Innovation became a defining theme as the organization positioned itself as a responsive and forward-thinking insurer.

2010s: Strengthening and Maturity

Throughout the 2010s, CLIMBS solidified its place as a trusted cooperative insurance provider. It expanded operations, digitized processes, and reached more members than ever before. This decade showcased not just growth, but maturity—CLIMBS was no longer just growing in size, but also in capability, influence, and social responsibility.

2020s: Resilience and Sustainability (2020–2024)

In the first half of the 2020s, CLIMBS reached unprecedented levels of growth. By 2024, premiums soared to 2.654 Billion, while claims amounted to 1.028 Billion. Despite rising risks and global uncertainties, CLIMBS has maintained its financial strength. This period reflects not just scale, but resilience and commitment—proof that the cooperative remains a reliable shield for communities in times of crisis.

Overall, this dataset tells a compelling story of growth, adaptability, and transformation. CLIMBS has matured in response to evolving risks, particularly those driven by climate change and socio-economic shifts. Through decades of challenges and change, it has expanded its reach and impact—continuing to fulfill its mission of providing protection and financial security in an ever-changing world.

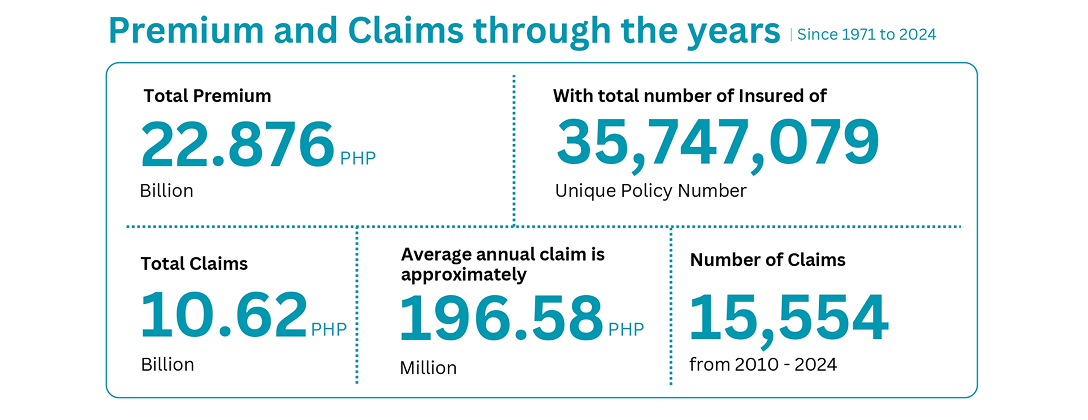

Over the years, CLIMBS has collected a total of ₱22.876 billion in premiums—an impressive testament to the scale of its operations and the deep trust placed in the cooperative by its policyholders. Serving over 35.7 million individuals and entities, CLIMBS has built a wide and inclusive network, reaching diverse communities across the country.

Out of the total premiums collected, ₱10.62 billion has been disbursed in claims, showing that CLIMBS has consistently fulfilled its promise of protection by returning nearly half of its collected funds to members during times of need. The average annual claim stands at approximately ₱196.58 million, reflecting the cooperative’s strong commitment to meaningful and substantial support—particularly in response to large-scale or community-wide events.

This data underscores CLIMBS’ financial strength, operational maturity, and its unwavering role as a reliable partner in risk protection and community resilience. Through decades of service, CLIMBS has not only grown in numbers but has deepened its impact in the lives of Filipino families and cooperatives.

Not sure what you need?

Contact us at +63 917 701 0662

or sign up for emails

By clicking Sign Up you’re confirming that you agree with our Terms and Conditions.

No spam. Unsubscribe anytime.